Employer Borang E

22 Sijil pendaftaran perniagaan bagi warganegara Malaysia yang menjalankan perniagaan. Employees remuneration information ie.

Borang Permohonan Jawatan Kosong Google Search Projects To Try Google Search

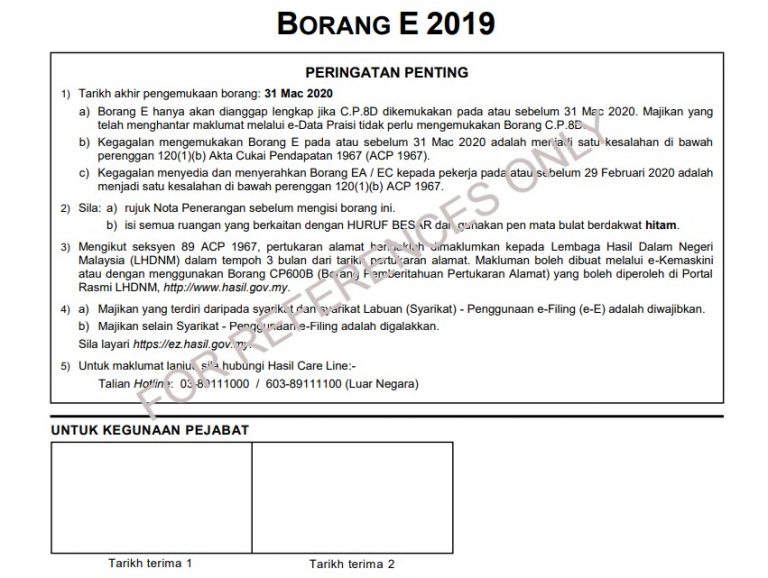

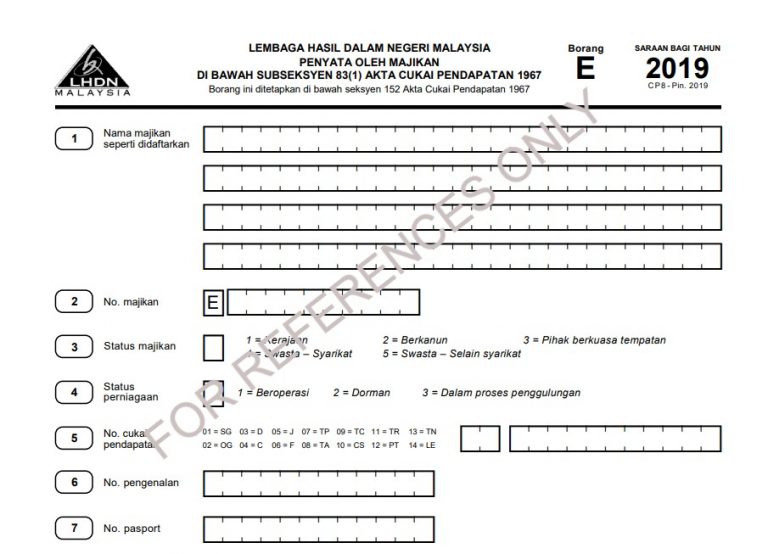

Form E is a declaration report submitted by every employer to inform the IRB on the number of employees and the list of employees income details every year not later than 31st March.

Employer borang e. If the prefill data is not submitted before that date the employer is required to submit the CP8D data together with the Form E in the prescribed format or via e-Filing. Knowledge Worker is Expert Worker Returning Expert Programme subject to approval by the Minister refer to PU. How do I submit Borang E.

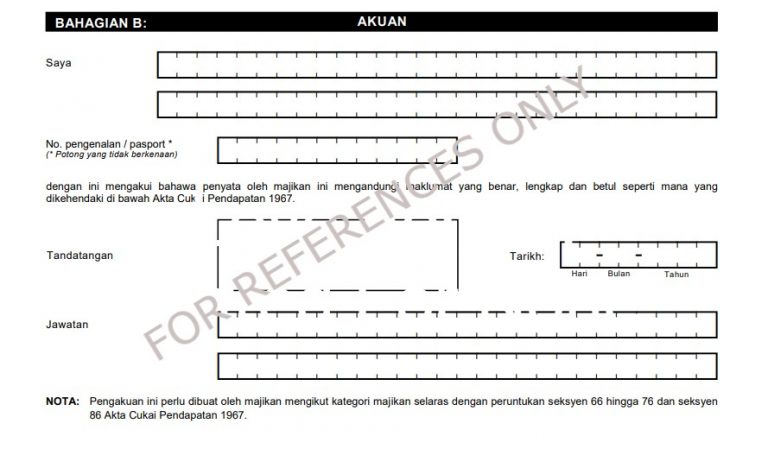

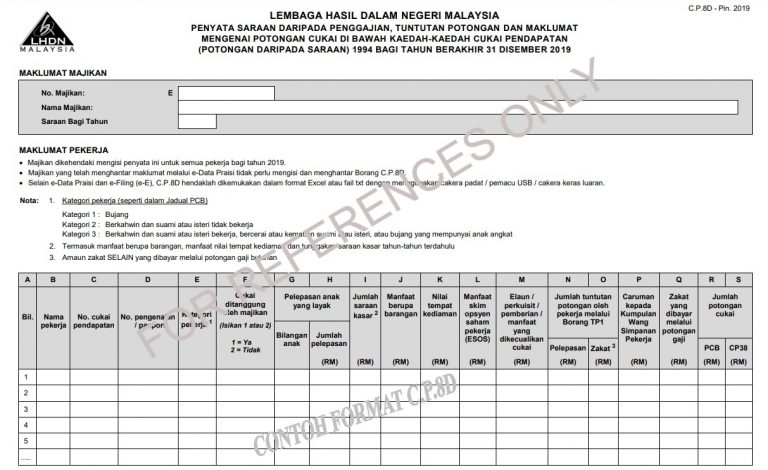

According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year. Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN. Enter 1 for Yes if the employer receives benefit from tax borne by their employer tax allowance.

B Failure to furnish Form E on or before 31 March 2019 is an offence under paragraph 1201b of. E 908915-10 - fill in as 0090891510 E 3943914-03 -fill in as 0394391403 E 90001541-01 - fill in as 9000151401. You will usually use this form to file.

Fill in your company details and select MUAT NAIK CP8D in the dropdown. Fill in companys full name. Upon selecting MUAT NAIK CP8D click Choose File to attach your HReasily TXT FILE and select MUAT NAIK to upload.

Use the code for relevant employees. A 1512012 in the LHDNM Official Portal. A Form E will only be considered complete if CP8D is submitted on or before 31 March 2019.

Hence itll be good for a company to use an online payroll system that is PCB-compliant and Borang E-ready. Fill in companys full address including postcode. The Borang E must be submitted by the 31st of march of every year.

ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2020 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. The following information are required to fill up the Borang E. Or Company Registration Number then click Proceed.

Details for ALL employees remuneration matters to be included in the CP8D. On and before 3042021. Employers who have e-Data Praisi need not complete and furnish CP8D.

Details for ALL employees remuneration matters to be included in the CP8D. 04112016 Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year. C Kegagalan menyedia dan menyerahkan Borang EA EC kepada pekerja pada atau sebelum 28 Februari 2019 adalah menjadi satu kesalahan di bawah perenggan 1201b ACP 1967.

Fill in the employers income tax number using10 digits. According to the Income Tax Act 1967 Akta 53. Form E is an employee income declaration report that employers have to submit every year.

Muat naik salinan dokumen berikut bersama permohonan. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Borang E contains information like the company particulars and details of every employees earnings in the company.

Firstly an employer must register the Employer E file first. Tax Borne by Employer. A 3442010 or PU.

Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Married and spouse is working divorced or widowed or single with an adopted child. The following information are required to fill up the Borang E.

21 Pasport bagi bukan warganegara Malaysia yang tidak menjalankan perniagaan. Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year. Form E Borang E 2016 is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB no later than 31 March 2017.

Lengkapkan borang pendaftaran online. Salaries wages allowance incentives. A rujuk Nota Penerangan sebelum mengisi borang ini.

Prefill of Remuneration Particulars in e-Filing. To facilitate taxpayers use of e-Filing in line with current technological development LHDNM is further reinforcing its. What is Borang E Form E.

Married and unemployed spouse. B isi semua ruangan yang berkaitan dengan HURUF BESAR dan gunakan pen mata bulat berdakwat hitam. Furthermore because LHDN no longer accepts manual forms all PCB calculations have to be done online.

Every employer shall for each year furnish to the Director General a return in the prescribed form. Select form type e-E and input your Income Tax No. Etc to be included in the CP8D form.

Resident Who Does Not Carry On Business. Resident who Carry On Business. Form E is a declaration report required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March.

Employer will also need to prepare Form EA for.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Web Portal Development Company India B2b Portal Development Company Mrmmbs Vision Enterprise Portal Website Development Company Development

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Cis 7 2014 Qlassic Task 3a Task Pdf Books Assessment

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Borang Pemarkahan Kerja Kursus Pendidikan Moral Spm Google Search Save Morals Crossword Puzzle

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Understanding Lhdn Form Ea Form E And Form Cp8d

Quora Ios Apps App Reference This Or That Questions App Answers

Https Ms Aksaraunited Com In 2020 Achievement First The Unit Kuala Lumpur

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Komentar

Posting Komentar